“No power on Earth can stop an idea whose time has come.”

When the late Dr. Manmohan Singh borrowed Victor Hugo’s words in 1991, India was opening its economy to the world. Three decades later — well after Singh’s two-term tenure as India’s Prime Minister — the spirit of that moment faces a very different test: what happens when the world starts closing its doors to India?

This past week, US President Donald Trump announced an additional 25% ad valorem duty on Indian goods, effective later this month, lifting effective tariff rates for some items to around 50% once you strip out exemptions.

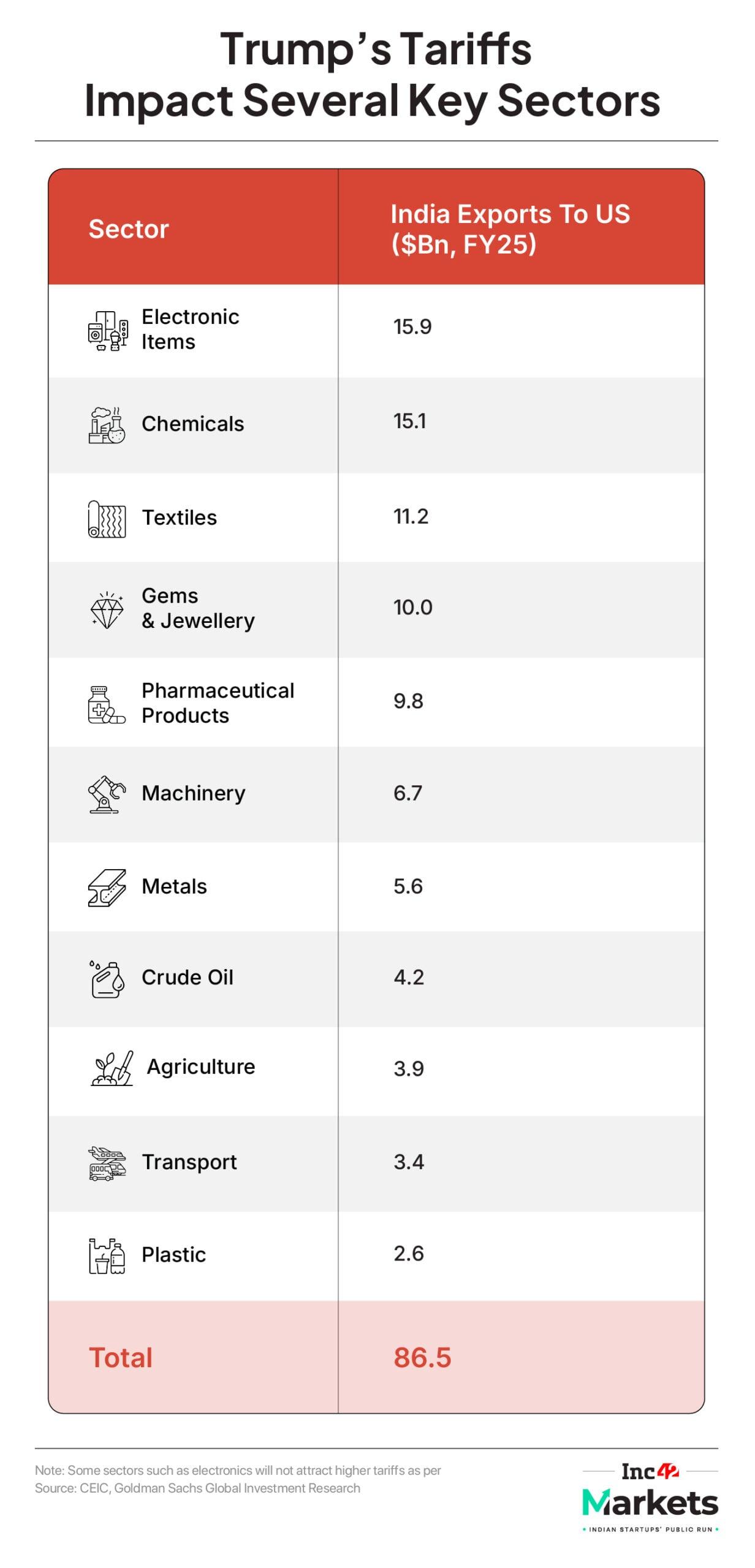

From an investor’s perspective, this isn’t just a geopolitical headline. The US is India’s single largest export market, $86.5 Bn in goods went that way in FY25, and the composition of those exports matters. Tariffs were once again the talk of the town.

Electronics, chemicals, textiles, pharma: all have high US shares. SBI Research estimates that in pharma alone, a tariff of this size could slice 5–10% off earnings for big exporters. Goldman Sachs puts the macro GDP drag at around 0.3 percentage points, small for the whole economy, but significant in concentrated pockets.

The “Direct Hit” SectorsTwo classic examples are home textiles and seafood. India’s home textile sector sends roughly 60% of its exports to the US. When tariffs lift landed costs for those goods, they lose price competitiveness in Walmart aisles and Amazon baskets overnight.

Seafood is smaller in market-cap terms but has a similar dynamic. Shrimp and frozen food majors like Apex Frozen Foods rely heavily on the US. A tariff this size, without offsetting incentives, will show up in quarterly numbers almost immediately.

As per SimranJeet Singh Bhatia, Senior Equity Research Analyst at Almondz Global, in the medium term these exporters will have to accelerate diversification to the UK and EU, where free trade agreements are already in place. That’s not just theory, textile players have been probing European buyers since FTA terms were announced.

“Unless you diversify into the European Union or UK, you lose competitiveness compared to Bangladesh,” he said.

For IPO-bound startups, the story is different but connected. Tariffs may not hit many of them directly, but if a large portion of their revenue depends on exports to the US, the timing of their listing could be in jeopardy. As Bhatia put it:

“If they are significantly dependent on the US, say, 20–25% of their revenue, the impact will be meaningful. They would have to postpone their IPO plan and re-strategise. Below that level, the effect will be there but more manageable. The real concern comes when US revenue forms a large share of the business; then, postponement becomes the prudent move.”

In practice, this means that a company with a model like Nykaa, if deriving 15–20% of sales from the US, would have to weigh whether to push back its IPO until the tariff situation stabilises. But a company like Lenskart, opening stores in the US but fulfilling locally, may see minimal impact and could still go ahead.

Thankfully, there aren’t many IPO-ready startups directly exposed to these duties, says Rajat Rajan, analyst at Kotak Mahindra Capital. He believes the situation is still unfolding, and it is yet to be determined if any new-age company will be materially affected.

Still, the current tariff uncertainty will make bankers, founders and investors more cautious in setting listing dates if US revenue is a meaningful slice of the pie.

A Colder Funding Climate?One quiet but important channel: foreign investor sentiment. Several global funds looking at Indian tech IPOs have US LPs and face their own geopolitical risk parameters. An active tariff war can lead them to widen required returns, slow deployment or push portfolio companies to pivot market strategies.

However, Bhatia believes that India’s macroeconomic data is quite stable. “There may be a few short-term fluctuations, but ultimately your earnings will matter quarter-to-quarter,” he said.

According to him, while Q1 wasn’t so great, profitability has improved for Indian companies because of lower raw material costs. Operating profit and bottom line have improved, even if the top line is muted.

Valuations are also correcting across sectors. A few months ago, small-cap along with mid-cap valuations were at their peak; now they’ve started to correct. Further, India also has a lower interest rate environment. Private capex is set to pick up, maybe by mid-2026. India’s GDP growth is expected at 6.25–6.5% as well.

All these factors, as per Bhatia, will keep attracting investors back to India, especially in domestic consumption sectors and companies with little US exposure. And that’s where Indian new age tech companies might see their stronghold. Because India’s push towards manufacturing was low, not many startups moved towards that direction sooner and hence, the risk from tariffs is relatively very low for them as well.

And the companies with heavy operations in the country might see investment in the short run, eg, Eternal.

How Will This Play Out?Trade history is full of reminders that tariffs don’t end innovation, they just redirect it. The 1930s Smoot–Hawley Act, often cited as a cautionary tale, slashed global trade volumes by two-thirds within a few years. It didn’t stop manufacturing but it rewired supply chains.

US firms brought production home, European manufacturers reoriented toward colonial markets, and smaller economies sought regional trade blocs to cushion the blow.

A more recent example came in 2018–2019, when the US–China tariff tit-for-tat sent electronics makers scurrying to Vietnam, Malaysia and Mexico. Production followed tariff relief, not national loyalty. And once supply chains moved, many didn’t return, even when politics thawed.

India’s startups are now standing at a similar junction. The direction of travel is clear: deepen local manufacturing ties, invest in offshore fulfillment hubs to serve tariff-heavy markets, or re-pivot growth towards regions with stable or preferential trade access, ASEAN, the Middle East, Africa, and parts of Europe under FTAs.

Deepinder Goyal, cofounder and CEO of Eternal, put it bluntly in a recent tweet: “Every few years, the world reminds us of our place. A threat here, a tariff there. But the message is the same: stay in your lane, India. Global powers will always bully us, unless we take our destiny in our own hands. And the only way to do that is if we collectively decide to become the world’s largest, most unapologetic superpower in the world.”

Markets Watch: New IPOs, Results And More- MapmyIndia’s PAT Zooms: The geotech company’s net profit rose 28% YoY to INR 45.8 Cr in Q1 FY26 while operating revenue rose 20% YoY to INR 121.6 Cr. MapmyIndia is also making an investment ofINR 25 Cr in quick commerce unicorn Zepto.

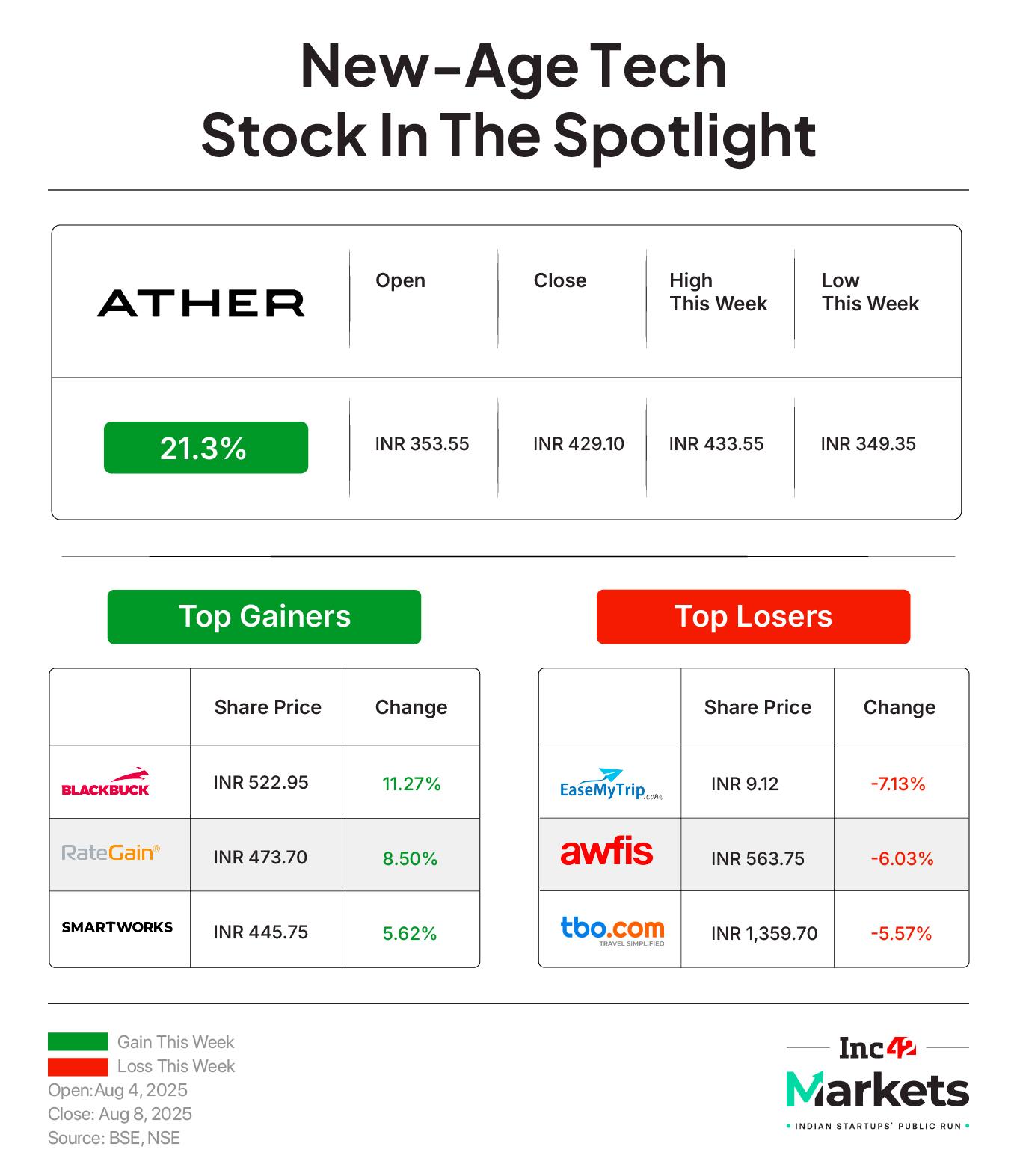

- BlackBuck’s Q1 Show: The logistics major reported a profit of INR 33.7 Cr in Q1 FY26, up 17.5% from INR 28.7 Cr in the year-ago quarter. Operating revenue zoomed 56% YoY to INR 143.6 Cr during the quarter under review.

- Ather’s Surge: The EV major narrowed its net loss by 3% to INR 178.2 Cr in Q1 FY26 from INR 182.9 Cr a year ago. Its operating revenue jumped over 79% to INR 644.6 Cr in the quarter under review from INR 360.5 Cr in Q1 FY25.

- Early Backers Dump Ola Electric Stakes: Z47 and Tiger Global Management pared down their holdings in the EV giant in Q1 FY26. While the former dumped 0.81% stake for INR 144 Cr, the latter diluted 0.21% shareholding in the company for INR 36.6 Cr

That’s all for this Sunday. See you next week with another edition of Inc42 Markets.

Till then,

Lokesh Choudhary

The post Trump’s Tariffs: A Roadblock For India’s Startup IPOs? appeared first on Inc42 Media.

You may also like

Blue Peter fans slam presenter's 'disrespectful' tribute to Biddy Baxter

Trump's Pakistan policy likely to land US in geopolitical turbulence

From Dhunuchi to Dissent: Kolkata's Durga Pujo to turn into a rally for Bengali pride with this year's theme

'We had lunch at Home Bargains Cafe and were baffled by the price of a pot of tea'

Moringa Benefits: This small plant cures 300 diseases, is beneficial for blood sugar and inflammation